By Greg Bluestein The Atlanta Journal Constitution Â

A Georgia Supreme Court ruling is shaking up the way insurance payments for damaged real estate are doled out, and it could have big consequences for homeowners across the state.

The court’s ruling found that home or building owners can now get special “diminution of value” payments when their buildings are damaged. That means insurers now must not only pay for repairs when a home or business is damaged, but they could also have to pay for the diminished value of that property.

The court’s ruling found that home or building owners can now get special “diminution of value” payments when their buildings are damaged. That means insurers now must not only pay for repairs when a home or business is damaged, but they could also have to pay for the diminished value of that property.The decision, a major shift in long-standing Georgia law, could mean far greater protections for property owners.

Insurance companies have warned it could force them to hike rates, and the firm involved in the case asked the court to reconsider its unanimous decision.

“This is a big deal for homeowners,” said former Insurance Commissioner John Oxendine, who supported the rule change. “It’s a major sweeping case that’s going to give a lot more rights to the insurance consumer. It’s one of the biggest cases for consumers that’s come down in years.”

It works like this: A homeowner whose foundation was damaged by a storm may get money to repair the house, but the home’s value could still plummet because owners have to explain its troubled past to potential buyers.

Georgia’s law has long held car insurers responsible under this rule. Owners of vehicles involved in a collision not only get money to repair their car but also funds to cover the lost value. But the court’s ruling in May applied this to commercial and residential real estate for the first time.

Attorneys say the decision took effect immediately, but the court has already been asked to reconsider its ruling, leaving it unclear when policyholders might benefit from the change.

It could mean big bucks for some homeowners. Each situation is evaluated on a case-by-case basis, but some property owners who have had water damage from a burst pipe or other severe problems could be eligible for these types of payments under the new ruling.

For cars, insurance companies have established a rough guideline of between 10 percent and 15 percent of the vehicle’s value for those damaged in the accident, some attorneys said.

“When an insurance company agrees to pay for your loss, you now have the right to be made whole for your entire loss,” said Alan Lubel, one of the attorneys who argued the case on behalf of a property owner. “To be made whole can involve not just repairing your property, but also paying for the loss to the property.”

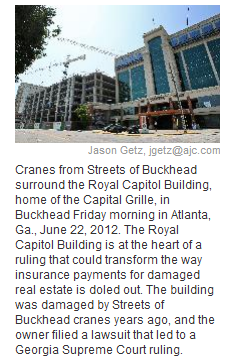

The ruling stems from the construction of The Streets of Buckhead development. David Davoudpour, a restaurant chain owner and investor, claimed in 2008 that the severe shaking and vibration on the development site caused structural damage and cracked the foundation of his company’s eight-story property next door, leading to other problems.

His company, Royal Capital Development, received about $1.1 million from his insurer, Maryland Casualty, to cover the damage. But Royal Capital filed a lawsuit seeking up to an additional $5.6 million to make up for the lost property value.

After a legal tug of war that went up to the federal appeals court, Georgia’s highest court weighed in with its unanimous opinion.

The opinion, written by Justice Hugh Thompson, said there was “no reason to limit” these types of payments to automobile policies. It said the law is designed to “place an injured party, as nearly as possible, in the same position they would have been if the injury had never occurred.”

Oxendine, who was Georgia’s insurance commissioner at the time of the lawsuit, issued a directive to insurers in April 2010 urging them to consider diminution or face disciplinary action.

“In some cases, even with repair of the property, it is possible that the property may be worth less after the loss than it was prior to the loss,” the directive said.

Experts said many insurance companies didn’t follow the directive, which was rescinded in January 2011 after Ralph Hudgens became insurance commissioner. His spokesman, Glenn Allen, said the decision has led to a “great deal of uncertainty” among insurers about its implication and could ultimately lead to higher rates.

Maryland Casualty wants the court to reconsider its opinion. Attorney Randy Evans said in a court filing that the nine-page ruling failed to resolve the dispute, and he asked the justices to decide whether the new policy should apply to all property insurance policies or on a case-by-case basis.

Insurance industry executives aren’t quite sure about the impact of the case, if only because Evans’ motion is still pending.

Some say the diminution concept is flawed because new repairs to a damaged home, such as a new roof, actually increase the home’s value without an extra payment.

“We’re just waiting to see how the court determines it,” said David Colmans, the executive director of the Georgia Insurance Information Service, an industry group. “We don’t really know at this point which way it will go, so we can’t understand what that downstream issue is going to be.”

Although insurers have said these payments could lead to rate hikes, some experts said they doubt it will change the way rates are assessed.

“The key is insurance companies now have to make people whole,” Oxendine said. “Now people have the certainty of knowing when they buy an insurance policy, they’re going to be made whole.”

What the court ruling means to you

– It could mean far greater protections for property owners. Insurers could have to pay for the diminished value of a property as well as pay for repairs when a home or business is damaged.

– Each situation is evaluated on a case-by-case basis.

– Insurance companies warn that such a rule will force them to raise insurance rates.

Published by