The Best Time to Refinance

A surprise interest-rate drop in January spurred a record number of homeowners to refinance. What you should know when rates fall again.

Illustration: Chris Gash

By: Anya Martin

February 27th, 2015

The Wall Street Journal

When mortgage broker Mathew Carson saw interest rates fall unexpectedly in January, he picked up the phone and called every home buyer he had worked with since the summer.

“My refinance business is 50% better than this time last year,†says Mr. Carson, of San Francisco, Calif.-based First Capital Group.

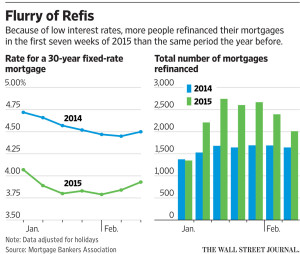

In a winter surprise, average interest rates for 30-year jumbo fixed-rate mortgages dropped below 4% for five weeks from the week ending Jan. 9 through Feb. 6, according to HSH.com, a mortgage-information website. As a result, refinance applications for jumbos and other mortgage types skyrocketed nationally by 49% in the week ending Jan. 9, the largest weekly gain since November 2008, according to the Mortgage Bankers Association. That’s 45% higher than the same week in 2014.

Rates were back to 4.06% for the week ending Feb. 20, according to HSH.com. And even a small rise can plug up the jumbo refinancing rush as quickly as it accelerated, says Mike Fratantoni, MBA’s chief economist. If rates drop by a quarter of a percentage point, “jumbo borrowers will turn their heads,†Mr. Fratantoni says. “But if that goes away, they are no longer interested.â€

Homeowners who missed the boat this time may wonder if refinancing is worth it the next time rates come down. A general rule of thumb for mortgage borrowers is to refinance when rates decrease by half of a percentage point. But because of their larger loan size, jumbo borrowers may save substantially even with one-eighth of a percentage-point drop, says John Schleck, centralized and online sales executive at Bank of America Home Loans, which also saw jumbo refinances spike.

Jumbo mortgages exceed government limits of $417,000 in most areas and $625,500 in some high-price places.

“If you’re borrowing $200,000, your monthly payment may go down just $28, but you might save $100 a month on a $700,000 loan,†Mr. Schleck says.

Homeowners should also calculate the number of months it will take for the money saved in monthly payments to cover the closing costs when refinancing, says Greg McBride, chief financial analyst of Bankrate.com, a personal-finance website.

Luxury Mortgage, a Stamford, Conn.-based lender that serves Connecticut, New Jersey and New York, has been able to offer some jumbo borrowers rates as low as 3.5% for loans up to $1.5 million, says Peter Grabel, managing director. Luxury also saw an uptick in calls from jumbo borrowers interested in lower rates surged, Mr. Grabel adds.

Borrowers have the option to pay closing costs upfront, but with rates so low, Mr. Carson says he has been able to wrap closing costs into the loan with an interest rate that’s slightly higher but still saving them money. In January, the lowest rates First Capital Group was able to offer for a 30-year, fixed-rate jumbo were 3.75% with $1,000 to $2,000 in closing costs and 3.875% with no closing costs.

A few more tips for borrowers considering a refinance of their jumbo mortgage:

• Tight qualifications. Because jumbo-loan amounts are high, borrowers who want the best rates will typically need a FICO credit score of 740 or above. And the loan-to-value ratio, which reflects the loan amount as a percentage of the home’s value, shouldn’t exceed 80%, Mr. Schleck says. Jumbo cash-reserve requirements usually are as high as 12 months of mortgage payments, rather than just two for conventional loans that fall within government limits, Mr. Carson says.

• Proper seasoning. Even if home values have risen in the area or the homeowner has made expensive improvements, many, but not all, lenders require 12 months “seasoning†before considering a new appraisal if the loan is a jumbo to be comfortable that the increased value will be sustained, Mr. Carson says. Because the loan-to-value will be based on the original appraised home value, this practice may disappoint people who want to borrow more or use a new appraisal to lower their loan-to-value ratio to improve rates.

• One size doesn’t fit all. Borrowers should consider their full financial profile and upcoming big expenses, such as retirement plans and a child’s college tuition, when deciding whether a fixed-rate mortgage is the best fit, Mr. Carson adds. Borrowers planning to sell their home within several years may save with an adjustable-rate mortgage.

Corrections & Amplifications

Greg McBride is the chief financial analyst at Bankrate.com. An earlier version of this article said he was the chief financial officer.

Published by